Assistant Surgeon Invoices

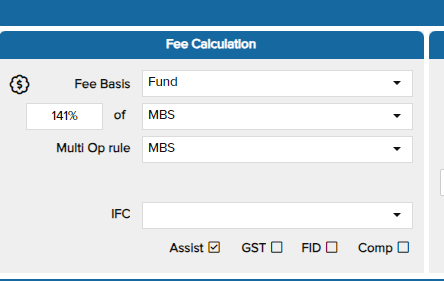

The Invoices screen for Surgeons has an Assist check box which should be

ticked for Assistant claims. Uncheck the Assist box for other claims,

such as consultations and non-surgical procedures, or if you are the

primary surgeon.

NOTE: You don't need to enter the Assist Item (eg 51300, 51303, 51306, 51309). Cutting Edge determines this for you as you enter the surgeon's items in the Items section.

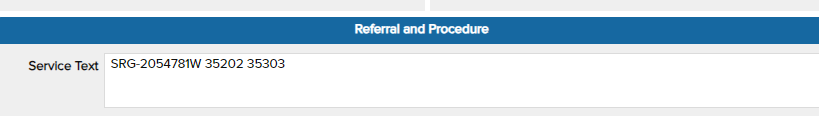

The software can only send one item (the Assist Item) with a date, a fee and the Service Text. None of the text in Descriptions on each surgical item gets sent. Due to limitations at the Medicare hub, Service text is limited to 50 characters (100 for DVA). This becomes challenging when there are more than 6 surgical items on one invoice.

Edit the Service Text with caution! If surgical details are missing the claim will be rejected or underpaid. Cutting Edge will warn you if the Service Text is too long to transmit.

NOTE: You don't need to enter the Assist Item (eg 51300, 51303, 51306, 51309). Cutting Edge determines this for you as you enter the surgeon's items in the Items section.

- Select the Surgeon and Hospital from the drop down lists. If you've entered different provider numbers for each hospital, the correct one will be shown as you change the hospital.

- Enter the surgeon's items in any order. Cutting Edge will sort them for you, apply the appropriate Multiple Operation Rule (e.g. for MBS 100% of the item with the largest fee, 50% of the second item, 25% of subsequent items), calculate the fee based on the rules for the selected fund and show the Assist Item in the Fee Calculation box.

- NOTE 1: Where the total MBS fee for the surgeon's items is below the threshold specified in the MBS (with Multiple Operation Rule applied), then the Assist item is 51300 and the Assist Fee is a fixed fee, displayed against the first item. Because the second item does not take the total over the threshold, and therefore does not affect the Assistant Fee, it displays a $0 value.

- You will also see the text update in the Service Text box. This is how we communicate the operation details to Medicare and Funds on Assistant claims.

The software can only send one item (the Assist Item) with a date, a fee and the Service Text. None of the text in Descriptions on each surgical item gets sent. Due to limitations at the Medicare hub, Service text is limited to 50 characters (100 for DVA). This becomes challenging when there are more than 6 surgical items on one invoice.

Edit the Service Text with caution! If surgical details are missing the claim will be rejected or underpaid. Cutting Edge will warn you if the Service Text is too long to transmit.

Related Articles

Enabling GST on Invoices

The GST check box in Provider settings needs to be ticked for GST to be an option on invoices. The reason for this is that only Providers who are registerd for GST can add it to an invoice. Those who are not registered mustn't add GST to their ...Importing Theatre Lists from Documents and Labels

Background, privacy and some important caveats Cutting Edge now supports extracting data from theatre lists to assist you to create your invoices! This function is a tremendous time saver especially for anaesthetists and assistant surgeons, ...Claiming for transoesophageal echocardiography (TOE) on anaesthetic invoices

Medicare benefits for transoesophageal echocardiography (TOE) by anaesthetists are payable with Item 22051, but not in association with items 55130, 55135 or 21936. Anaesthetic claims should not include item 55130, no benefit will be payable. From ...Abandoned Surgical Procedures

In some cases Medicare allows providers to make a claim when a surgical procedure is abandoned for medical or other reasons. For surgeons, the fee in this case is calculated at 50% of the fee which would have applied had the procedure not been ...Handling two or more identical services on the same day with Not Duplicate Service flags

Medicare checks that electronic claims are not duplicates of other claims that have already been paid. This can cause issues where a patient requires more than one consultation on the same day, or is taken back to the operating theatre. To improve ...